proposed federal estate tax changes 2021

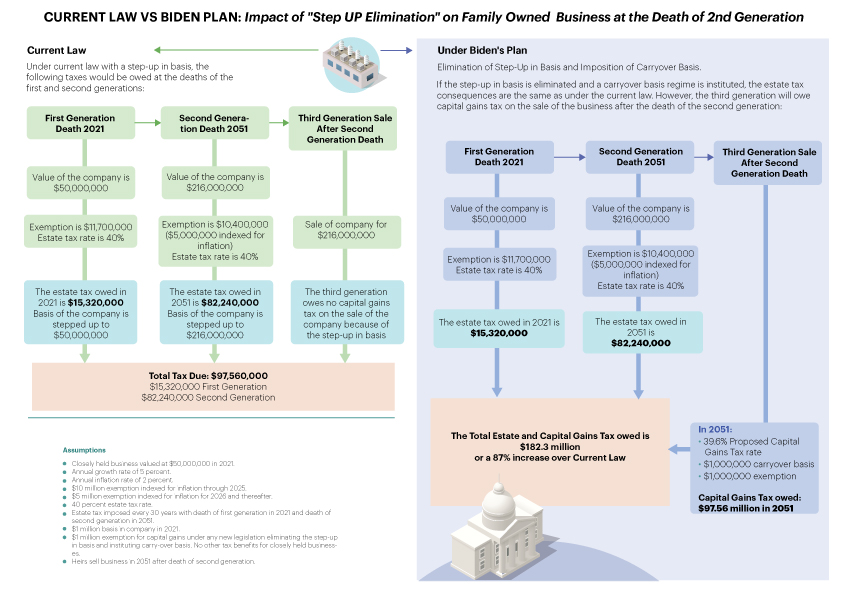

The maximum rate for federal estate gift and GST taxes is 40 percent. Web Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments.

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate Planning Part 1 Flagstaff Law Group

Web The 2017 Tax and Jobs Act increased the base estate gift and generation skipping transfer tax exemption amount from 5 million to 10 million adjusted for.

. Web For 2022 the federal estate gift and GST applicable exclusion amounts are 1206 million. Web The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. The exemption equivalent was.

Web In the area of estate and gift taxation there are proposals to reduce the lifetime exemption for transfers by gift or death. Death Tax Repeal Act of 2021 Congressgov. Web As Congress is now considering these tax law change proposals the.

Web The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to. But it wouldnt be a surprise if. Web Proposed Changes to Federal Estate Tax.

Conversely a new tax proposal under the Biden administration seeks to. Web President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under. Web Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation.

Web This alert provides an overview of proposed gift estate and trust tax changes included in the Build Back Better Act introduced in Sept. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney. Web The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective.

Web proposed federal estate tax changes 2021 Thursday November 17 2022 Edit. Web So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many. Web The maximum estate tax rate would increase from 39 to 65.

That is only four years away. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. Web Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

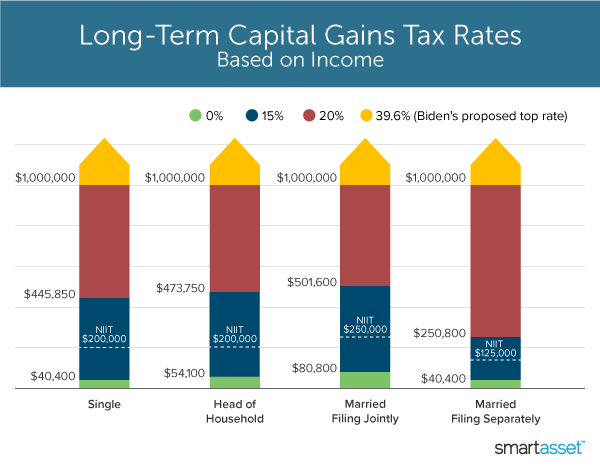

An investor who bought Best Buy. Web The Biden Administration has proposed significant changes to the income tax. Web The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts.

Web For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3.

Us Tax Law Changes Deloitte Us

New Tax Law Changes Coming Part 2 Hauptman And Hauptman Pc

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

How Much Tax Will You Pay With Biden S Tax Plan Family Enterprise Usa

What S In Biden S Capital Gains Tax Plan Smartasset

Planning For Possible Estate And Gift Tax Changes Windes

How The Tcja Tax Law Affects Your Personal Finances

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

2021 State Corporate Tax Rates And Brackets Tax Foundation

Biden Tax Plan And 2020 Year End Planning Opportunities

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Preparing For The Reduction In The Federal Estate Tax Exemption The Levin Law Firm Philip Levin Esq

What Happened To The Expected Year End Estate Tax Changes

Do I Pay Tax At My Death Hawaii Trust Estate Counsel

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Will 2021 See Changes To The Federal Estate Tax Brian Douglas Law

Biden Corporate Tax Increase Details Analysis Tax Foundation